The Easiest Way to Have It When you Need It

Unlock up to $2M in a line of credit at competitive rates

draw capital whenever you want instantly to a debit card.

Or give us a call at (407) 606-6756

Funding in 3 Easy Steps

It's a simple risk free process to join thousands of business owners getting an edge with business financing.

Step 1

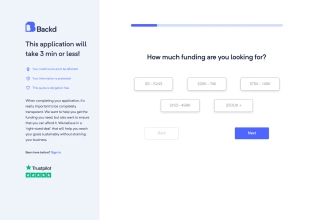

Apply Online

Secure financing for your business by completing our online application.

Step 2

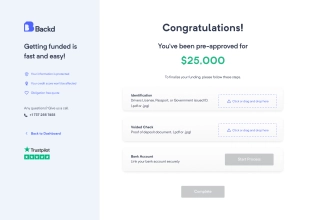

Receive Decision

Receive pre-approval immediately once your business financials are submitted electronically.

Step 3

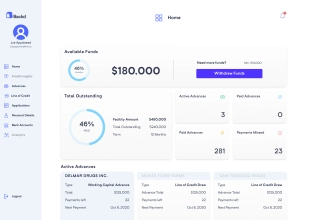

Use Your Funds

Once approved, you'll receive the funding in less than 24 hours!

Onyx lends based on more criteria's than credit score. Onyx utilizes a soft credit pull so your credit score is never affected when applying for the funding you need.

No Risk, Just Maximize.

We Lend Beyond Credit Score.

100M+

Total Funding Disbursed to Our Clients

340+

Business Owners Served

We understand each business owner's unique situation and meet them where they are, providing tailored lending solutions that fit their specific needs. Our personalized approach ensures you get the capital you need, no matter your credit history.

FAQ

What type of credit score do I need to qualify for funding?

At Onyx, we cater to both individuals with good and bad credit. We understand that your credit score is just one aspect of your financial health. Our goals is to find the best loan terms and highest amounts by setting up your file for success, regardless of your credit score.

How does Onyx ensure it finds the best loan terms for me?

We utilize a thorough process where we shop around with multiple lenders to compare loan terms. This approach allows us to secure the most favorable rates and terms tailored to your unique financial situation, ensuring your application is positioned for the best possible outcome.

What information do I need to provide to apply for funding?

To streamline the funding process and increase your chances of success, you'll need to provide basic personal information, details about your business, including financial statements, not including tax returns but preferred. This information helps us tailor our search for the best loan terms specifically for you.

How long does the funding process take?

The timeline can vary depending on the complexity of your file and the type of funding you are seeking. Typically, the process from application to receiving funds can take anywhere from a few days to several weeks. We strive to expedite your application while ensuring thorough consideration is given to securing the best terms.

What should I do if I have previously been denied?

Don't be discouraged! Onyx Alliance specialized in setting up files for success, even for clients who have faced denials in the past. We recommend discussing your previous application with us so we can understand any potential issues and adjust your new application accordingly, improving your chances of approval.

ONYX ALLIANCE, LLC | 2024 All rights reserved

1309 Coffeen Ave, Suite 1200, Sheridan, WY, 82801

Loans made or brokered in Florida are made or brokered pursuant to Florida Finance Lenders License No. 60DBO-129171

All applications are subject to the credit providers credit assessment and loan eligibility criteria. Terms, conditions, fees and charges apply. Information provided is factual information only, and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

Your interest rate may be different and is based on a number of factors, including your credit history, the information you provide and our assessment of your application. We'll confirm your interest rate upon submission of your application. Rates, repayments and fees are estimates and are subject to change at any time.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.