Partner with Experts! Why Our Experience Matters in Securing Your Funding

As a business owner, you face numerous challenges, from maintaining cash flow to securing the capital needed for growth. Traditional lenders often impose stringent requirements and lengthy processes, leaving you struggling to find the necessary funds quickly. Additionally, navigating the complexities of improving your credit score can be daunting, especially when you need to secure higher credit limits to fuel your expansion.

At Onyx Alliance, we understand these obstacles and offer tailored solutions to help you overcome them. With our expertise in business funding and credit repair, we provide comprehensive support to ensure you receive the capital you need without the usual headaches. Here’s why partnering with us can make all the difference:

Proven Track Record of Success

Our team has successfully aggregated over $100 million in lending, demonstrating our ability to secure substantial funding for businesses of all sizes. This extensive experience means we know what it takes to get your application approved and funded quickly.

Personalized Service

We believe in a personalized approach to funding. Our experts work one-on-one with you to understand your unique business needs and craft tailored financing solutions. This ensures you get the best possible terms and conditions for your specific situation.

No Upfront Fees

Unlike many other agencies, Onyx Alliance does not charge expensive upfront fees. You pay nothing until you receive the funding you need, making our services a risk-free investment for your business.

Comprehensive Credit Boosting

We offer expert credit boosting services to help improve your credit score, opening up even more financing opportunities. Our team works diligently to identify and dispute inaccuracies on your credit report, boosting your score and enhancing your borrowing potential.

Flexible Financing Options

We provide a range of financing options, including 0% interest funding and high credit limits, tailored to your business needs. Our strong relationships with key lenders enable us to secure the best possible terms for you.

No Hard Credit Pulls

Worried about hard credit pulls affecting your score? With Onyx Alliance, there are no hard credit pulls during the initial evaluation process. This ensures a risk-free and secure path to securing the funding you need.

Expertise in Holistic Evaluation

Our funding approach goes beyond just your credit score. We take a holistic view of your business, considering factors such as cash flow, business performance, and growth potential. This comprehensive evaluation allows us to secure more funding for you, even if your credit score isn't perfect.

Long-Term Financial Planning

We don't just focus on immediate funding needs; we also help you create a bulletproof plan for long-term financial success. Our experts provide strategic advice to ensure you have the capital necessary for sustained growth and stability.

Strong Client Relationships

Our commitment to client success goes beyond just securing funding. We build strong, lasting relationships with our clients, providing ongoing support and guidance to help your business thrive.

Industry-Leading Expertise

With years of experience in the business funding industry, our team possesses the knowledge and skills needed to navigate the complexities of securing capital. Partnering with Onyx Alliance means you're working with the best in the business.

Choosing Onyx Alliance for your business funding needs means partnering with experts dedicated to your success. Our proven track record, personalized service, and comprehensive support make us the ideal choice for business owners looking to overcome capital restrictions and achieve their financial goals. Let us help you unlock your business potential today.

Hi ! My name is Kevin Vieira, and I founded Onyx Alliance

With my 12+ years in marketing and building tons of new different companies, and a lot of them failing... I understood the struggle of not having enough capital to not only just grow the business, but to keep the doors open as well.

That's why I founded Onyx Alliance, the strongest solution for business owners like you to secure big funding that are the: cheapest loan rates you'll ever find with the lowest monthly payments while securing 6 to 7 figures in funding.

Finally, the roadblocks of having enough money to pay employees, invest in inventory, spend money on marketing, and give you a fair chance to compete with giant corporations.

Benefits You Can Expect

Low Interest Rates

Save Money

No Hard Pulls

Risk-Free Applications

Fast Funding

Immediate Access to Capital

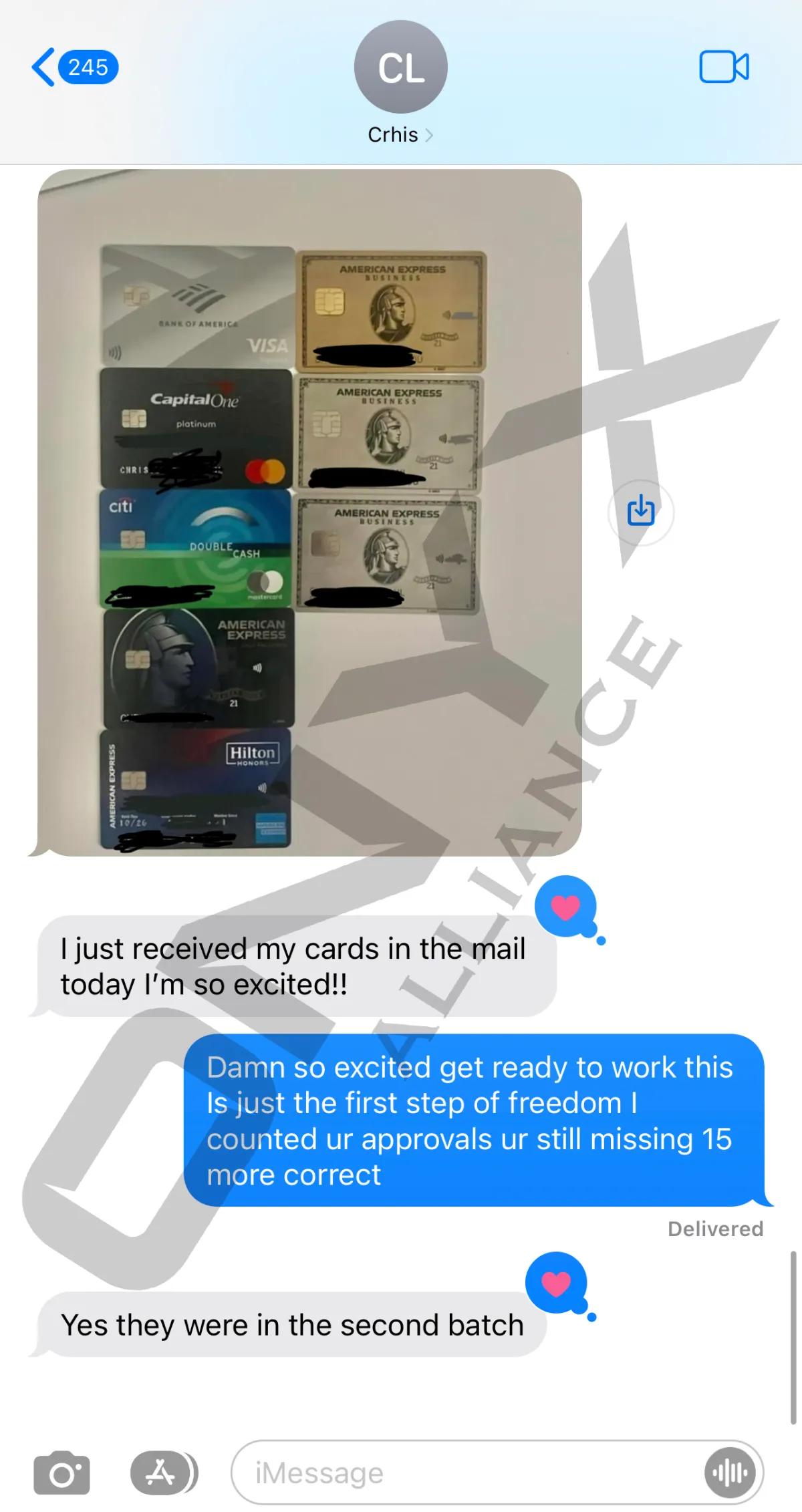

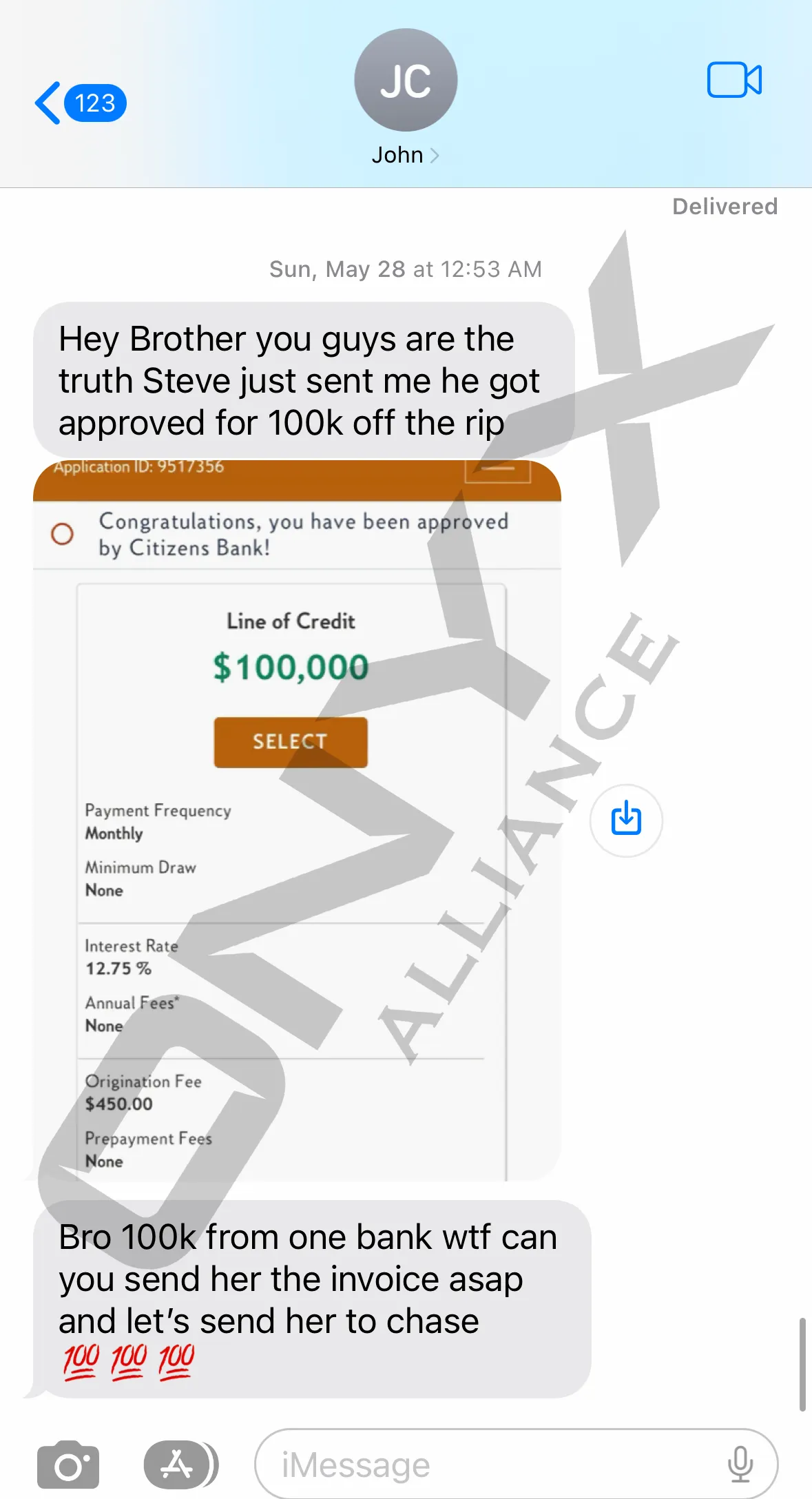

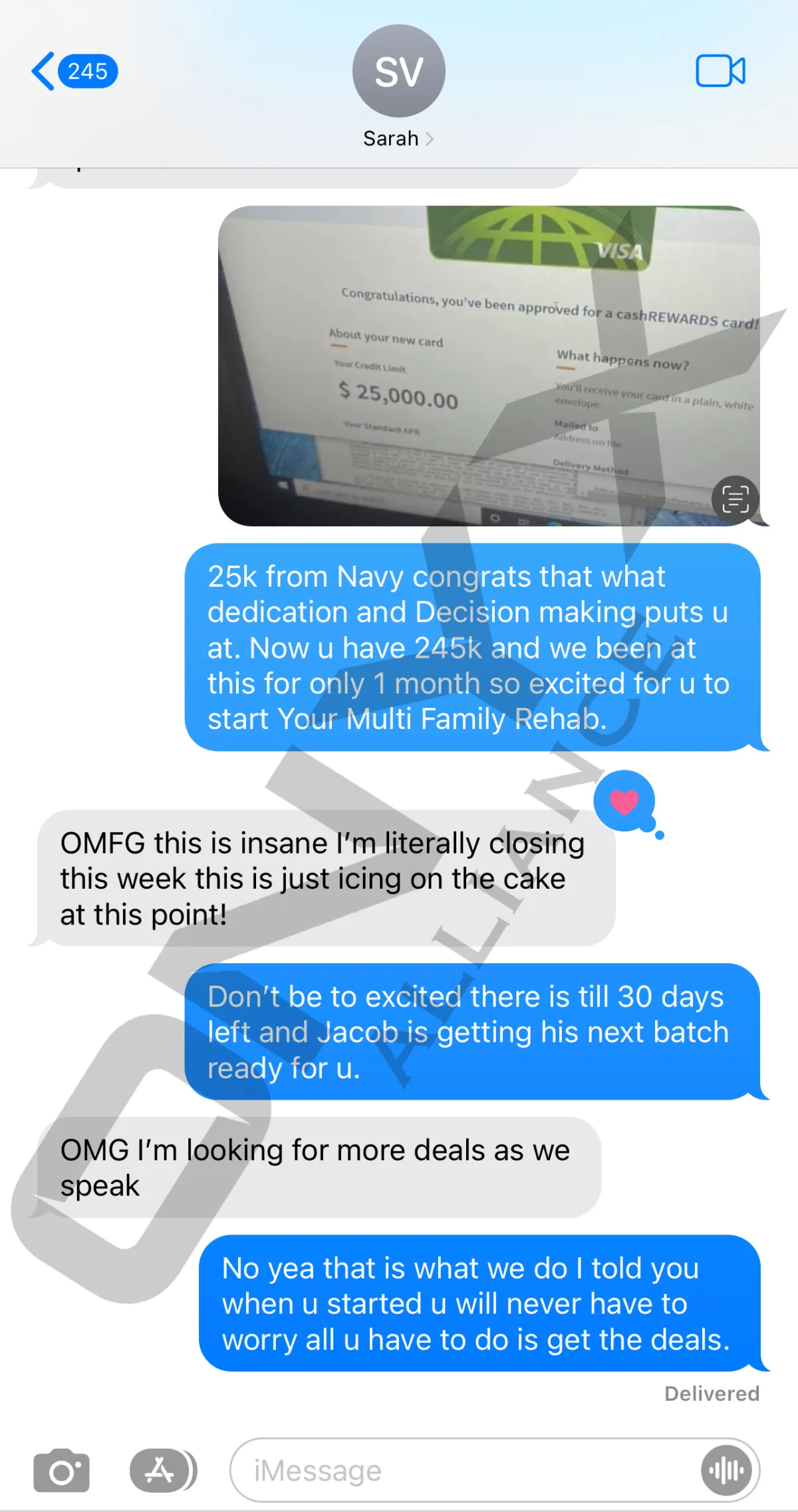

Success Stories

Don't take our word for it! Here are some of our incredible clients

Funding in 3 Easy Steps

It's a simple risk free process to join thousands of business owners getting an edge with business financing.

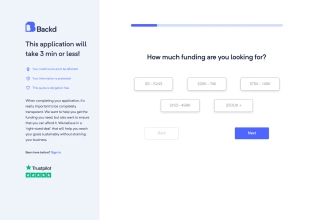

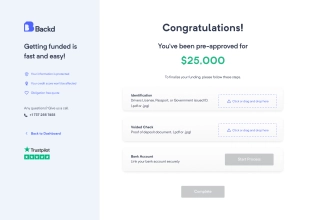

Apply Online

Secure financing for your business by completing our online application.

Receive Decision

Receive pre-approval immediately once your business financials are submitted electronically.

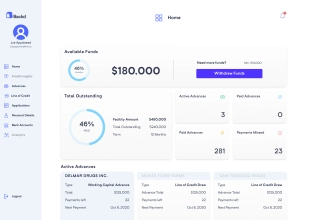

Use Your Funds

Once approved, you'll receive the funding in less than 24 hours!

Here's What You'll Get...

1 on 1 support with high level loan and credit experts

Daily Office Hours 8am to 8pm EST Monday to Friday

Access to online portal with videos and guides

Reliable Funding Partner

Credit Boosting Methods

Business Credit Builder

Tailored Financial Planning

Eligibility Search for Government Grants & Tax Credits

Proven Funding Strategy to Borrow $1M+

Access to Relationship Managers

1 on 1 support with high level loan and credit experts

Daily Office Hours 8am to 8pm EST Monday to Friday

Access to online portal with videos and guides

Reliable Funding Partner

Credit Boosting Methods

Business Credit Builder

Tailored Financial Planning

Eligibility Search for Government Grants & Tax Credits

Proven Funding Strategy to Borrow $1M+

Access to Relationship Managers

Ready to Get Started?

ONYX ALLIANCE, LLC | 2024 All rights reserved

1309 Coffeen Ave, Suite 1200, Sheridan, WY, 82801

Loans made or brokered in Florida are made or brokered pursuant to Florida Finance Lenders License No. 60DBO-129171

All applications are subject to the credit providers credit assessment and loan eligibility criteria. Terms, conditions, fees and charges apply. Information provided is factual information only, and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

Your interest rate may be different and is based on a number of factors, including your credit history, the information you provide and our assessment of your application. We'll confirm your interest rate upon submission of your application. Rates, repayments and fees are estimates and are subject to change at any time.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.